Global shipping faces new regulatory pressures, geopolitical upheaval, and the biggest disruption to seaborne global oil trades since 2008, just as economic indicators signal the world may be heading into a recession.

Europe is firing up coal plants to avert an energy shortage as Russia cuts pipeline natural gas supplies, boosting imports and tonne miles for the global fleet of bulk carriers, tankers and LNG carriers.

The complex patchwork of Russian sanctions introduced by the US, UK and EU countries have upended oil markets, disrupted crude exports, and lifted oil prices to the highest in more than a decade as demand for transport fuels surges on easing travel restrictions.

The sanctions triggered a surge in commodities prices stoking inflationary fears, months ahead of the introduction of international and European regulations to decarbonise shipping.

Two short-term emissions measures, the Carbon Intensity Indicator or CII and Energy Efficiency Index for Existing Ships, known as EEXI, begin from January 1. According to LR research, backed up by third party findings, about 80% of the existing fleet will have to sail at slower speeds or apply some other form of carbon abatement to comply.

The new metrics will potentially change how vessels operate, impacting their sailing speeds and routes, introducing yet another factor to influence dynamics over the next 12 months.

Patchy tanker turnaround

Airlines are flying again, the cost of transport fuels across Europe and the US is the highest ever and even refineries are enjoying record profit margins.

But the long-anticipated turnaround for the fleet of internationally trading tankers has been patchy and uneven.

Larger sizes have been excluded from a rebound in rates that kicked off over the second quarter to end a protracted pandemic-induced, loss-making earnings slump that exceeded 18 months.

The global fleet of some 2,200 medium-range tankers are the highest-profile beneficiaries of geopolitical instability and associated oil price volatility.

The dislocation of refined products trading on the back of recovering demand for middle distillates such as jet fuel and diesel across North America and Europe has rates gaining by around 140% since April.

As a result, MR tankers -- the workhorses of the product tanker fleet -- now enjoy the best trading conditions since 2008 in the Pacific region as middle distillate shortfalls underpin firmer freight rates creating arbitrage trades.

Tightening sanctions on Russia, a major supplier of diesel to Europe, have diverted export volumes of refined products from the US Gulf, Asia and the Middle East Gulf.

Earnings for MR tankers in the Pacific region exceeded $70,000 daily over June while rates for very large crude carriers that are three times larger hovered at levels between minus $20,000 per day and $12,000 daily, shipbroker indices show. Daily rates can vary depending on vessel age, fuel efficiency and whether they have sulphur abatement equipment that allows them to burn cheaper marine fuel oil.

Negative numbers for Very Large Crude Carriers (VLCCs) reflect falling oil demand from China, the biggest importer of crude. The International Energy Agency forecast in June that Chinese oil demand would contract for the first time this century in 2022, before leading a global rebound in 2023.

Some 75% of seaborne oil to China is shipped on VLCCs, making the segment the most vulnerable to China’s zero-Covid policy that locked down more than 60 million people over April and May while industrial and factory output contracted.

Furthermore, VLCCs don’t load oil from Russian Baltic and Black Sea ports, excluding them from the spike in tanker earnings seen on direct routes serviced by smaller suezmax and aframax crude tankers.

Tankers are now sailing longer distances as discounted Russian volumes head to India, Turkey and Asia amid a degree of self-sanctioning among some Western shipowners and refineries.

Europe and the UK agreed to cut Russian imports of crude and refined products by the end of this year, while US embargoes began in April. Bans on marine insurance and reinsurance for tankers loading oil from Russia that apply from the end of 2022 will limit liftings to ships and port states prepared to accept alternate providers, likely from Asia, or state guarantees from Russia.

New refinery capacity is also being added in the Middle East Gulf and China from later this year into 2023, when global throughput exceeds pre-pandemic levels for the first time.

The Russian-led recalibration of global energy commodities extends to liquified natural gas. LNG trades are projected to rise 5% in 2022, according to the IEA, a slightly slower pace than last year’s 6%.

Some 65% of the increase comes from the US, where exports are estimated to rise 19% as new liquefication capacity came online. Shipments to Europe to restock inventories in time for winter have more than doubled in the past two years, keeping spot rates for the LNG carrier fleet counter-seasonally elevated.

Boxships boom to bust?

Container lines reported a record $44bn in profits in the first quarter of 2022 but the surge in demand alongside global port congestion that outpaced ship capacity and created such positive trading conditions is cooling.

Sky-high freight rates to ship boxes and record-breaking chartering costs for vessels might continue into 2023, but inflation-led headwinds and looming overcapacity signal an end to the unprecedented boom times spanning more than two years.

There are early signs of weakening as consumers divert spending from goods to services in Europe and North America, as Covid-related restrictions ease in most countries bar China.

April’s global export volumes were 4.2% lower than the prior-year period, indicating demand is softening, according to the Container Trade Statistics, a subsidiary of the Brussels-based European Liner Affairs Association.

The supply of boxships is expected outpace demand as deliveries of new ships begin in 2023, accelerating in 2024 and 2025.

Container lines’ profits drove orders at shipyards for new ships to 765 worth $61 billion over the past 18 months, according to shipbroker VesselsValue.com. Alongside liquefied natural gas carriers, the containership orderbook-to-fleet ratio for this vessel type exceeds 25%.

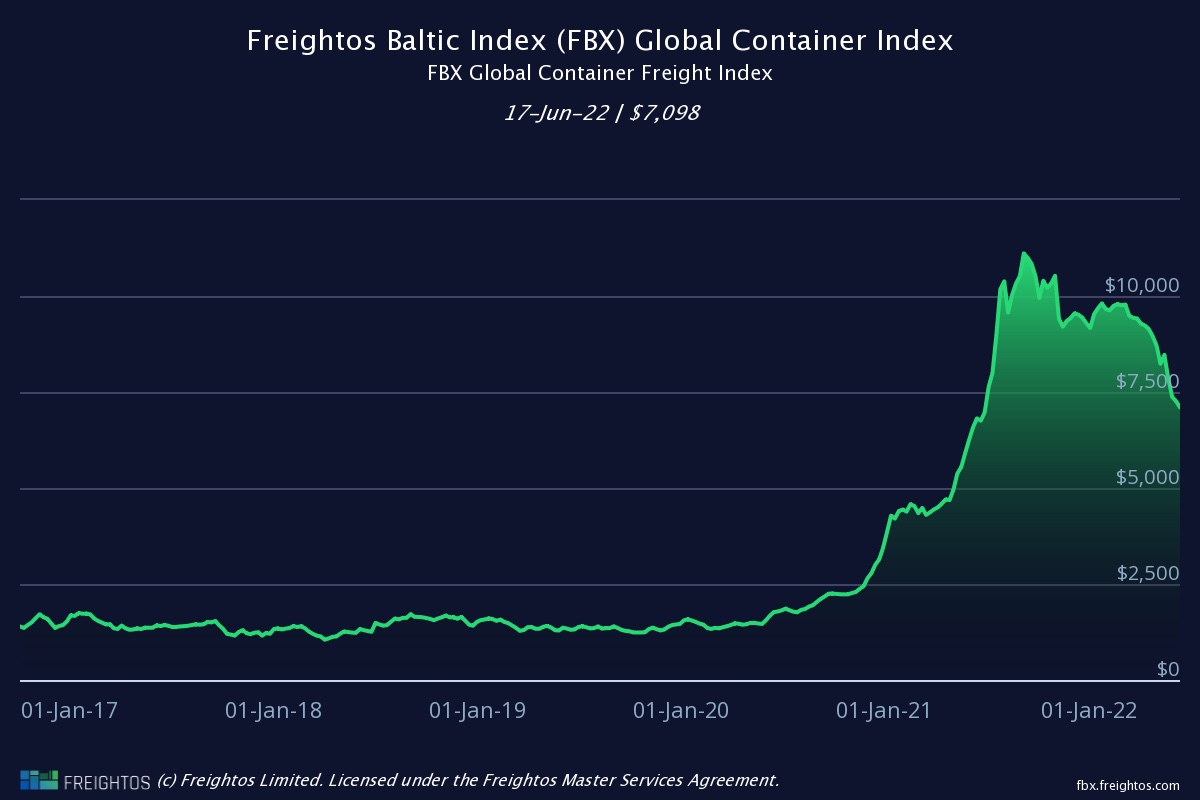

The Freightos Baltic Index, a global assessment of spot container freight rates is down 35% from the September 2021 peak but remains 4% above the year-ago period. Many shippers switched to multi-year and longer-term container freight rates in the past 18 months as lines sought to lock in profits beyond 2022.

Some services from China were cancelled because of extended Shanghai lockdowns which has eased pressure on global port congestion, especially on the Asia-US West Coast route.

Logjams at the ports of Los Angeles and Long Beach were at the centre of international logistics chaos that plagued the US supply chain throughout the pandemic and prompted the first US shipping reforms in 23 years. President Joe Biden signed the shipper-friendly Ocean Reform Shipping Act of 2022 into law in June.

China weighs on dry bulk prospects

China accounts for some 35% of dry cargo demand so what happens in the second half of 2022 will be closely watched as the country comes out of lockdown.

Year-to-date imports of iron ore and coal are all lower than 2021, as the strict zero-Covid policy spills over to global trade.

The Baltic Dry Index, an indicator of bulk carrier freight rates, is down 13% year-on-year. Average freight rates for the four vessel types and sizes are all within a range of $24,000 to $26,000 per day.

This reflects the disparate outlooks for minor bulk commodities. Grains are shipped on smaller sized bulk carriers which are outperforming larger capesizes that predominantly discharge cargoes in China from Brazil and Australia.

Like oil and gas, coal trade flows are changing as European sanctions on Russian coal kick in at the beginning of August. Europe is also boosting its reliance on coal as an energy source over gas, a positive for panamax-sized vessels that serve this market.

Russia’s war on Ukraine has disrupted some 19 million tonnes of wheat exports from Ukraine, driving grains prices to record levels and adding to inflation pressures.

Argentina, Brazil and to a lesser extent India are expected to pick up some of the slack. India has flip-flopped over whether to ban wheat exports. Australian and Indonesian governments have made similar threats over coal, injecting fresh supply risks that would spill over to earnings prospects on these trades.